Are You Familiar With How We Can Help?

We can help provide your business with the working capital you need. Scroll down and checkout summaries on the services we offer.

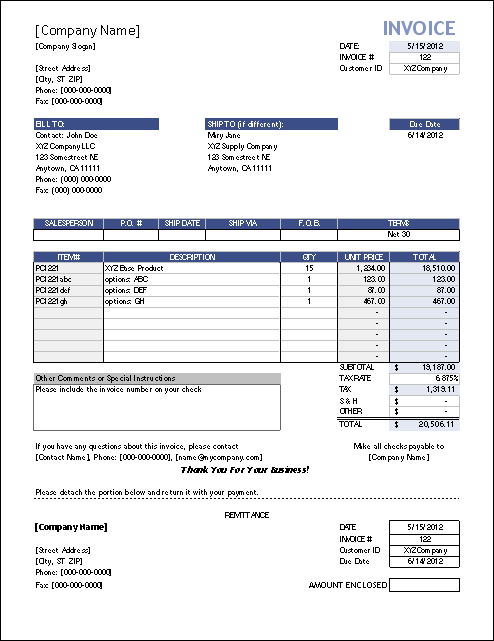

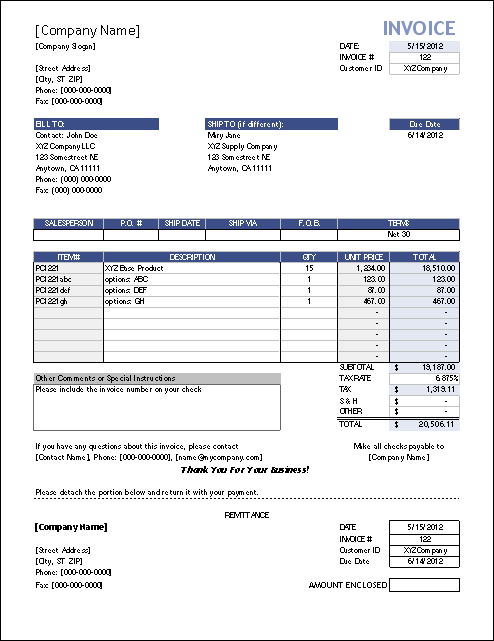

Invoice Factoring

Invoice Factoring is definitely one of the most valuable tools used by small and mid-size business to obtain business funding.

Purchase Order Factoring

Purchase Order Financing involves the financing of an order rather than financing the delivery of products or services.

Medical Receivables Factoring

Factors consider a medical receivable as a receivable owed to a medical provider by a patient's third party payor.

Export Import Factoring

Export, Import factoring or international factoring is a rapidly growing form of commercial finance that is replacing usage of traditional letter of credit transactions.

Freight Factoring

Freight factoring is a form of invoice factoring that allows transport companies, including owner-operators, to turn unpaid invoices into immediate cash.

Asset-Based Lending

Asset-based loans typically use product inventories and account receivables as primary loan collateral. They are very similar in many ways to account receivable factoring.

Merchant Cash Advances

Merchant cash advances is a type of financing where cash advances are forwarded on future credit and debit card sales.

Forfaiting

is a specialized form of export-import trade finance used for larger transactions with extended payment terms. To be considered, your customer needs to exhibit outstanding international credit.