Are You Familiar With How We Can Help?

We can help provide your business with the working capital you need. Below is a brief overview of our main services. More can be reviewed by clicking on "What We Do"

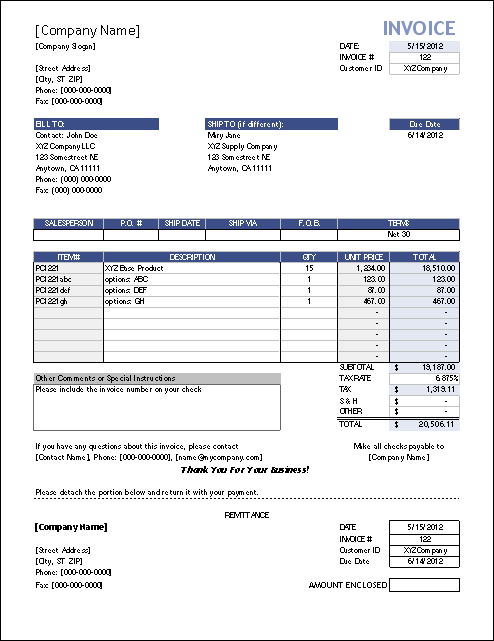

Invoice Factoring

Invoice Factoring is definitely one of the most valuable tools used by small and mid-size business to obtain business funding.

Purchase Order Factoring

Purchase Order Financing involves the financing of an order rather than financing the delivery of products or services.

Medical Receivables Factoring

Factors consider a medical receivable as a receivable owed to a medical provider by a patient's third party payor.

Export Import Factoring

Export, Import factoring or international factoring is a rapidly growing form of commercial finance that is replacing usage of traditional letter of credit transactions.